In a recent webinar Mara White, product manager for Outback Power discussed the huge opportunity for storage and the growth of the solar market. Here’s a recap. You can watch the full webinar here.

Storage is a critical part in the PV industry, as we see a lot of different fragments or segments of market data in the news. We have the opportunity to dig a little bit deeper into how the energy storage market fits into solar and some of the drivers as we look forward over the next three years. We can overlay the energy storage market on top of some of the solar market data.

Solar’s on a roll

Solar’s on a roll

PV as a whole is a $14 billion business right now in the U.S. Over the next three years, PV plus energy storage is going to exceed that half mark to $8.2 billion by 2018. Really, that means that there’s been more solar installed in the past 18 months than the 30 years prior. Ten years ago, we used to have a solar system go in about once every 1.5 hours, and currently there’s a solar system going in once every four minutes. Cumulatively, for the U.S., we have more than 13,000 MW installed.

We have 55 GW of solar installed globally, U.S. solar installation capacity is right in between the Asian and EMEA markets. The adoption in recent years has mostly been driven by government incentives and aimed at promoting the adoption of renewable energy. Historically the market’s been dominated by Europe, or countries that have offered incentive schemes, but recent years you can see, beginning in 2012, lot of that growth has had a down turn where incentives were cut heavily during that time. In 2014 it starts to pick up in some regions. A lot of the expected growth between now and 2018 is going to be in Asia and in the Americas. In the market projects chart, there’s a little dip in America in 2017 due to the expiration of the ITC. This type of global view includes both grid connected and off-grid PV. Storage has historically been seen in the off-grid market.

How storage could help drive solar post-ITC

Now, let’s discuss how the development of storage for PV is essential to increase the ability of PV systems to replace existing energy sources. Annual PV storage is expected to grow from 50,000 MW to more than 70,000 MW in the next three years. Annual PV installations with energy storage is a subset of the whole industry, but growing at a substantial rate. Reports from six months ago showed solar really dropping off in 2017. Now, storage is anticipated to be a new market driver to help the PV industry stay consistent, and even pick up speed over the next three years. Storage in grid-connected applications is a new market, and storage plus PV is being used to replace existing energy sources.

The solar grid-connected residential and off-grid markets are expected to grow substantially over the next three years. These are small markets that could really encroach into the larger market.

Market opportunities in solar plus storage

Turning installed megawatts into dollars, PV energy storage revenues are forecast to rise from $3.2 billion as of 2014 to $8.2 billion in 2018. Off-grid systems currently drive most of the PV plus energy storage revenue, only about 9% of the revenue from solar plus storage is from grid-connected systems. But grid-connected systems are projected to drive 28% of solar plus storage revenue by 2018.

Really, energy storage can be deployed in most PV markets today. You’re going to see growth across grid-connected segments projects, with the largest growth in the commercial utility portions.

For example, in many regions the commercial electricity tariff varies throughout the day, and the charges are applied to bills based on peak electricity demand. Energy storage can be used to reduce usage at certain times of the day, and therefore drive down electricity bills.

Whereas on the grid-connected residential level, home owners install PV to generate electricity during the day, but often have their highest demand in the morning or after work. Storage can be used to retain surplus electricity and use it at a later time. New grid connected residential solar plus storage installations are also expected to exceed the growth of retrofitted installations, when you add storage to an existing solar site usually through AC coupling. Having designs for new systems will be a benefit because they will enable more flexibility, primarily more options for interoperability and newer technologies.

The biggest hurdle to solar plus energy storage

The biggest hurdle to solar plus energy storage

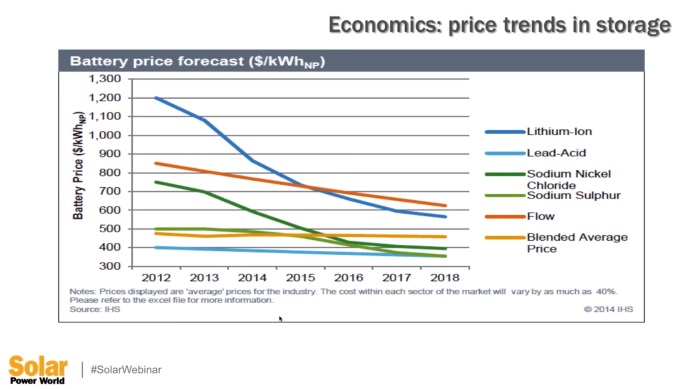

In PV plus energy storage, the price of storage technologies is one of the biggest hurdles, especially in the off-grid world. All battery chemistries are predicted to decrease in price over the next few years. The blended average of these prices will remain pretty constant. This is really based on kW/hr based on nameplate.

Looking outside of storage in solar

It’s always good to double check the data from a different perspective. Looking outside of the PV industry, you can see a list of disruptive technologies including energy storage specific to renewable energy: IHS ranks the top 10 global technologies transforming the world as 10. artificial intelligence, 9. biometrics, 8. flexible displays, 7. sensors, 6. advanced user interfaces, 5. graphene, 4. energy storage and advanced battery technologies, 3. 3-D printing, 2. cloud computing and big data, 1. the internet of everything. Energy storage and advanced technologies will be critical to maintain the reliable electricity grid.

Right now solar makes up 0.06% of the world’s electricity. We expect that solar move to replacing the gas line over the next 20 years, as gas in turn replaces coal. The by proposition here is that residential energy storage is where PV was six or seven years ago, and the factors that lead PV to this mass affordability will have to have a similar effect on storage. Battery cost are declining, in the past decade there have been dozens of start up companies and far safer and more efficient types of inverter and storage technologies.

Other drivers for energy storage

You can see the cost of a completely installed system has multiple components, especially in the storage installations. You’re going to have a huge contributing factor of battery prices declining and panel site prices declining, so the complete installed system overall is still heading down. With the increased volume and popularity, there is a lot of different reasons people are adding solar. It may not just be the back up that primarily has been the driver for the off-grid business so far. People install solar for a variety of reasons. It could be be to save money, benefit the environment or provide back-up power.

Another driver includes world-wide grid challenges. Having a means to store the power for energy sources so you can safely and reliably use it later and have power in times of crisis is going to help drive the storage business. Germany is one of the most advanced and has the most mature PV markets in the world. Even the grid stability in that area is a huge driver for some of the energy storage. We know that the grid architecture across all of Europe is definitely under certain conditions can be a problem. We see energy storage uptake across the world being a bellweather for domestic needs already. In the U.S., California gets about 15% of its electricity from renewables, with the goal of more than 20% percent by 2020, just five more years. Programs and incentives help drive renewables and help stablize California’s grid. Also, storms like Katrina and Hurricane Sandy also drive battery back-up.

In a survey from one of our larger installers, 11% of their residential customers had energy storage back-up but more than 50% were interested in having it in case of an outage. There’s still a quarter of people who say no way, but given the population offering energy storage is still a huge market opportunity.