The U.S. energy storage market just had both its best quarter and best year of all time. According to the GTM Research/Energy Storage Association’s U.S. Energy Storage Monitor 2015 Year in Review, the U.S. deployed 112 megawatts of energy storage capacity in the fourth quarter of 2015, bringing the annual total to 221 megawatts. This represents 161 megawatt-hours for the year.

The 112 megawatts deployed in the fourth quarter 2015 represented more than the total of all storage deployments in 2013 and 2014 combined. Propelled by that historic quarter, the U.S. energy storage market grew 243 percent over 2014’s 65 megawatts (86 megawatt-hours).

The report breaks down the market into three segments: residential, non-residential and utility. The utility segment, also called front-of-meter, continues to be the bedrock of the U.S. energy storage market. In 2015, front-of-meter storage accounted for 85 percent of all deployments for the year. Most of these deployments were in the PJM market, where over 160 megawatts of energy storage systems went on-line in 2015.

The residential and non-residential segments combine to make up the behind-the-meter market. While much smaller, the behind-the-meter market grew 405 percent in 2015. The report notes that the residential market is geographically diverse but was led by Hawaii for the year. California led the non-residential segment.

GTM research forecasts that the annual U.S. energy storage market will cross the 1-gigawatt mark in 2019, and by 2020 it will be a 1.7-gigawatt market valued at $2.5 billion.

“We can look back at 2015 as the year when energy storage really took off,” said Ravi Manghani, GTM Research senior energy storage analyst and author of the report. “While most of the growth was limited to a single wholesale market of PJM, we expect growing interest for storage in several markets.”

“Energy storage is changing the paradigm on how we generate, distribute and use energy. With exponential growth predicted over the next couple of years, energy storage solutions will deliver smarter, more dynamic energy services, address peak demand challenges and enable the expanded use of renewable generation like wind and solar,” said Matt Roberts, executive director of the Energy Storage Association (ESA), adding, “The net result will be a more resilient and flexible grid infrastructure that benefits American businesses and consumers.”

Today, more utilities are considering storage along with an assortment of traditional and non-traditional assets to meet reliability, capacity and system upgrade needs. The recent extension of several federal renewable tax credits is expected to further boost energy storage as more storage paired with renewables will be deployed.

Key Findings

– The U.S. deployed 111.8 megawatts of energy storage in Q4 2015, which was higher than deployments in 2013 and 2014 combined.

– The U.S. deployed 221 megawatts of storage in 2015, up 243 percent over 2014.

– Installed system prices for utility projects for energy applications to be completed in 2017 will be lower by 29 percent versus 2015, and for power applications, the prices will be lower by 25 percent.

– GTM Research forecasts that the annual U.S. energy storage market will cross the 1-gigawatt mark in 2019 and by 2020 will be a 1.7 gigawatt market valued at $2.5 billion.

– In 2015, front-of-meter storage accounted for 85 percent of all deployments for the year.

– 20 state markets had energy storage policy activity in 2015, up from 10 states in 2014.

Today, the business group Advanced Energy Economy announced that total revenue for global advanced energy was a record $1.4 trillion in 2015, making the industry twice as big as the airline industry, bigger than apparel/fashion, and approaching worldwide spending on media and entertainment. The U.S. advanced energy market hit $200 billion, nearly double the nation’s beer market, larger than pharmaceutical manufacturing, and closing in on wholesale consumer electronics.

Today, the business group Advanced Energy Economy announced that total revenue for global advanced energy was a record $1.4 trillion in 2015, making the industry twice as big as the airline industry, bigger than apparel/fashion, and approaching worldwide spending on media and entertainment. The U.S. advanced energy market hit $200 billion, nearly double the nation’s beer market, larger than pharmaceutical manufacturing, and closing in on wholesale consumer electronics. Wednesday, March 30, 2016

Wednesday, March 30, 2016

Deep Chakraborty,

Deep Chakraborty,  Bob Giles,

Bob Giles,  Jim Jenal,

Jim Jenal,  Kathie Zipp,

Kathie Zipp,

SnapNrack, a manufacturer of solar panel mounting solutions, celebrates a joint UL 2703 listing with Enphase microinverters and SolarEdge optimizers. Under SnapNrack’s UL 2703 listing and with the launch of their MLPE Rail Attachment Kit, installers are no longer required to bond optimizers with ground lugs and bare copper. When using microinverters, ground lugs and bare copper are also not required to bond module rows. Installing a system using the MLPE Rail Attachment Kit will help further reduce labor and material cost.

SnapNrack, a manufacturer of solar panel mounting solutions, celebrates a joint UL 2703 listing with Enphase microinverters and SolarEdge optimizers. Under SnapNrack’s UL 2703 listing and with the launch of their MLPE Rail Attachment Kit, installers are no longer required to bond optimizers with ground lugs and bare copper. When using microinverters, ground lugs and bare copper are also not required to bond module rows. Installing a system using the MLPE Rail Attachment Kit will help further reduce labor and material cost.

Most inverter manufacturers recommend a maximum of 5% voltage drop for the system— typically 2.5% on either side of the inverter. On large systems, many designers specify an even tighter value of 3% total or less, to maximize the energy harvest.

Most inverter manufacturers recommend a maximum of 5% voltage drop for the system— typically 2.5% on either side of the inverter. On large systems, many designers specify an even tighter value of 3% total or less, to maximize the energy harvest. Storage technology is crucial to the growth of solar, but its deployment could be challenging. Grid-connected energy storage lacks clear expectations and standards among manufacturers, so how can developers know their systems will operate correctly and safely?

Storage technology is crucial to the growth of solar, but its deployment could be challenging. Grid-connected energy storage lacks clear expectations and standards among manufacturers, so how can developers know their systems will operate correctly and safely?

Challenges to storage testing

Challenges to storage testing

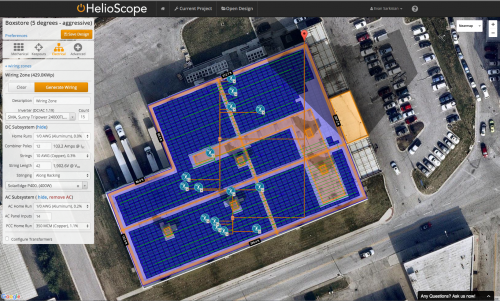

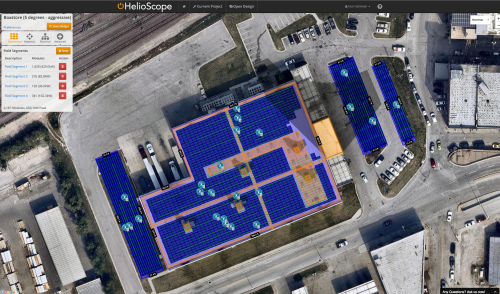

This example is a classic case of a portfolio sale. The key elements of a portfolio sale are to break up the customer’s holdings into separate pieces and evaluate each of them individually. As a result, you can determine the subset of the projects that make the most sense and prioritize them above the others. In other words, you are turning down work if it doesn’t make financial sense for the customer. This builds credibility, by showcasing the fact that you are optimizing for customer value rather than your own revenue.

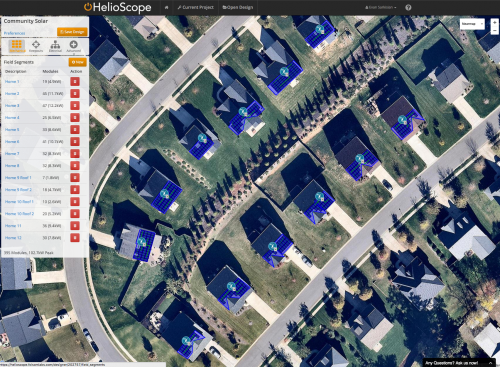

This example is a classic case of a portfolio sale. The key elements of a portfolio sale are to break up the customer’s holdings into separate pieces and evaluate each of them individually. As a result, you can determine the subset of the projects that make the most sense and prioritize them above the others. In other words, you are turning down work if it doesn’t make financial sense for the customer. This builds credibility, by showcasing the fact that you are optimizing for customer value rather than your own revenue. Alternatively, you could show their system in the context of their neighborhood, showing how their rooftop is better than their neighbors’ for installing solar. And if it isn’t, you can give them handouts to give to their neighbors for referrals!

Alternatively, you could show their system in the context of their neighborhood, showing how their rooftop is better than their neighbors’ for installing solar. And if it isn’t, you can give them handouts to give to their neighbors for referrals! The main advantage to this approach is that winning a portfolio of projects can have a dramatic impact on a company’s bottom line. It’s more than just a big boost to revenue–having one main negotiation can mean significantly reduced customer acquisition costs. It can also give you the flexibility to stage out the installation process to keep costs low.

The main advantage to this approach is that winning a portfolio of projects can have a dramatic impact on a company’s bottom line. It’s more than just a big boost to revenue–having one main negotiation can mean significantly reduced customer acquisition costs. It can also give you the flexibility to stage out the installation process to keep costs low. Ingeteam has just commissioned a solar photovoltaic (PV) plant in Minster, Ohio. The Minster PV plant, owned by Half Moon Ventures LLC, out of Chicago, IL has received an investment of $15 million. Thanks to the 4.3MWdc (3MWac) of installed solar capacity, this plant will produce 5.83GWh of energy per year. In addition, the facility has 7MW of power batteries, which will improve penetration rates of the plant in the distribution network and reach an estimated savings of $6,375,000.

Ingeteam has just commissioned a solar photovoltaic (PV) plant in Minster, Ohio. The Minster PV plant, owned by Half Moon Ventures LLC, out of Chicago, IL has received an investment of $15 million. Thanks to the 4.3MWdc (3MWac) of installed solar capacity, this plant will produce 5.83GWh of energy per year. In addition, the facility has 7MW of power batteries, which will improve penetration rates of the plant in the distribution network and reach an estimated savings of $6,375,000.